15 Funny People Working Secretly In A1 Certificate Buy Experiences

페이지 정보

작성자 Rafael 작성일24-12-23 07:35 조회4회 댓글0건관련링크

본문

A1 Certificate Updates and Common Issues

As the global workforce expands and changes the process of ensuring compliance with international employment regulations is becoming more difficult. Recent changes to A1 forms, along with common issues, highlight the importance of knowing these forms.

If you're traveling for business in several European countries A valid A1 certificate is required. But do you know when it's needed and how to get one?

1. Getting Started

The A1 Certificate streamlines cross-border work arrangements. It is a practical solution that is also legally sound for both employees and employers. The certificate guarantees that employees are not subject to the social security laws of more than one country, thereby preventing overpayments and administrative burdens. Anyone who is posted to an EU member state is required to carry this certificate. However, it can be used by employees who travel to other countries for business purposes such as attending conferences, meetings or fairs.

The procedure for getting an A1 certificate is different from country to country, however the fundamental steps are the identical. Employees should first confirm their eligibility, then complete the appropriate form with the competent authority. The form includes the information about their home country as well as the employer and destination country they will be working in. In most cases, it is best to complete this form online. Then, employees must submit the form along with the relevant documents to their home country's social security authorities.

After the A1 certificate is issued, it is able to be used in any country of the European Union. However, there are simplified procedures for those who frequently travel to different EU countries. For example If an employee or self-employed worker frequently engages in business in two or more Member States it is possible to apply for a type of permanent certificate that allows them to continue contributing to the system in their home country for a period of up to two years.

Those who don't secure an A1 certificate prior to going for a trip related to work could be penalized with fines. Inspectors from France, Austria, and Switzerland have launched a recent series of inspections targeted at companies that do not give their employees the required documents. Local authorities can refuse access to a construction site in the event that, for instance employees are sent there without an A1 certificate. Employers and hosting firms that do not secure their employees A1 certificates may also be penalized with fines. It is important to start the A1 certification process as soon as possible.

2. Documentation

The A1 certificate is an important piece of documentation for workers who travel to different countries frequently to work. The certificate demonstrates that the worker is covered in his or her home country. This permits them to avoid paying social insurance premiums in other countries. This could save companies a lot of money over the long run. But, it's crucial for employers to be aware of the documents required by their employees to complete this form.

Employees who work abroad must possess a valid A1 certificate to avoid paying penalties and fines. This is particularly true for project workers who may be required to display the certificate when entering hotels or attending conferences. It's also helpful to keep up-to-date with the most recent A1 certificate rules and regulations, since there have been some recent changes that could affect the way this process is conducted.

The primary goal of the A1 certificate is to stop social dumping. This occurs when an employee from a member of the EU is transferred to another state without being covered by the social security system in their home country. The A1 certificate is designed to prevent this by proving that the worker is covered in their home country. Employees, civil servants and self-employed individuals must get an A1 certificate when they're sent to another EU member state or Iceland, Norway, Liechtenstein, or Switzerland for work-related reasons.

A1 certificates are usually issued by the health insurance company for the person in question. The form is essentially an email that contains details like the name of the person and address. It also has a specific area which lists the country in which the person intends to work, as well as an explanation of the nature of work to be carried out there.

If an employee plans to work in the UK it is necessary to include information regarding their schedule and activities that generate income. Keep accurate time and location records to ensure that you're eligible to receive the A1 certificate if the local authorities want to inquire about your information.

3. Payment

A1 Certificates prove that employees contribute to the social security system of their home country when temporarily working in an European country. This can help to avoid social and wage discrimination in the event of short-term cross-border work assignments. It also allows employers to avoid double contributions in cases of multiple placements that overlap in different countries.

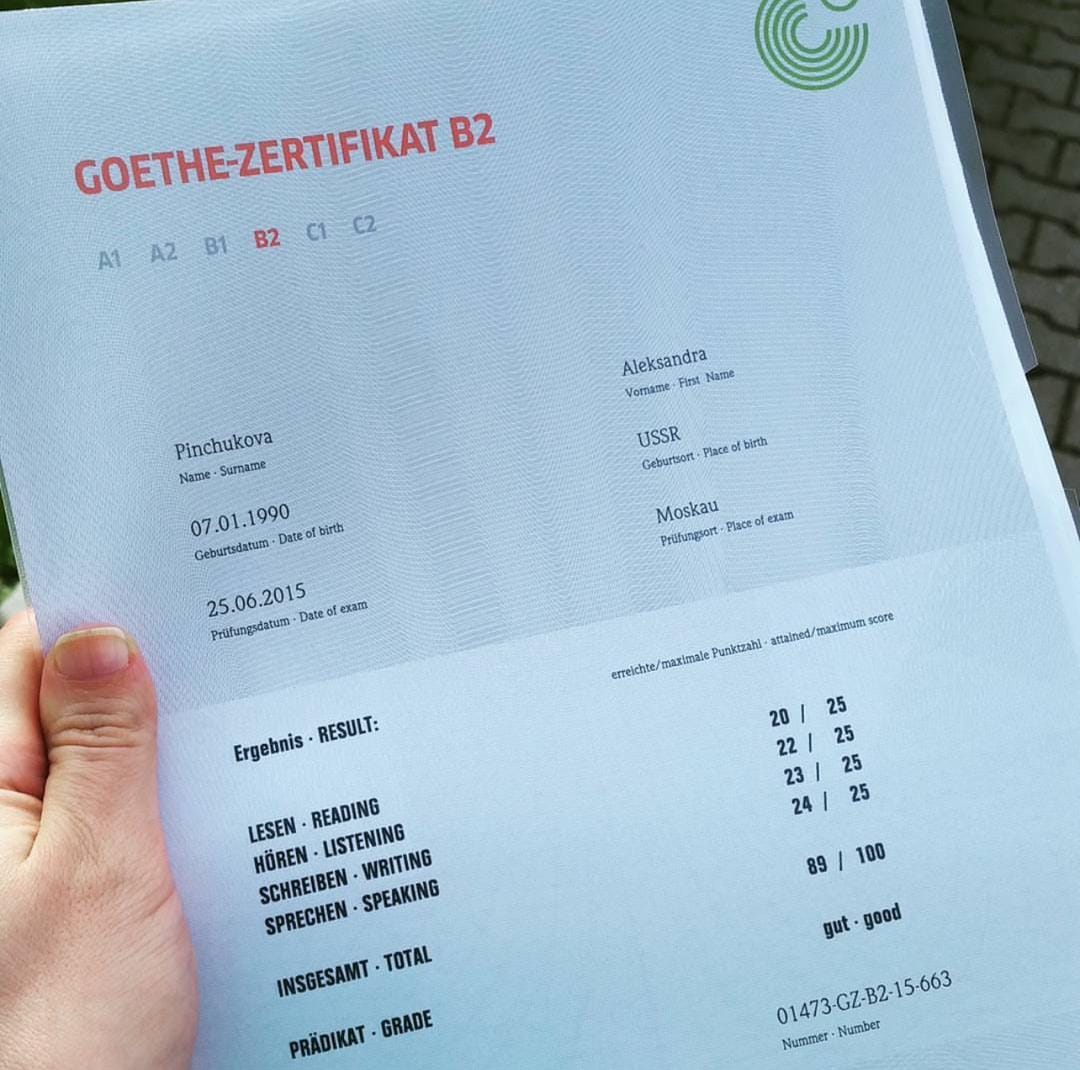

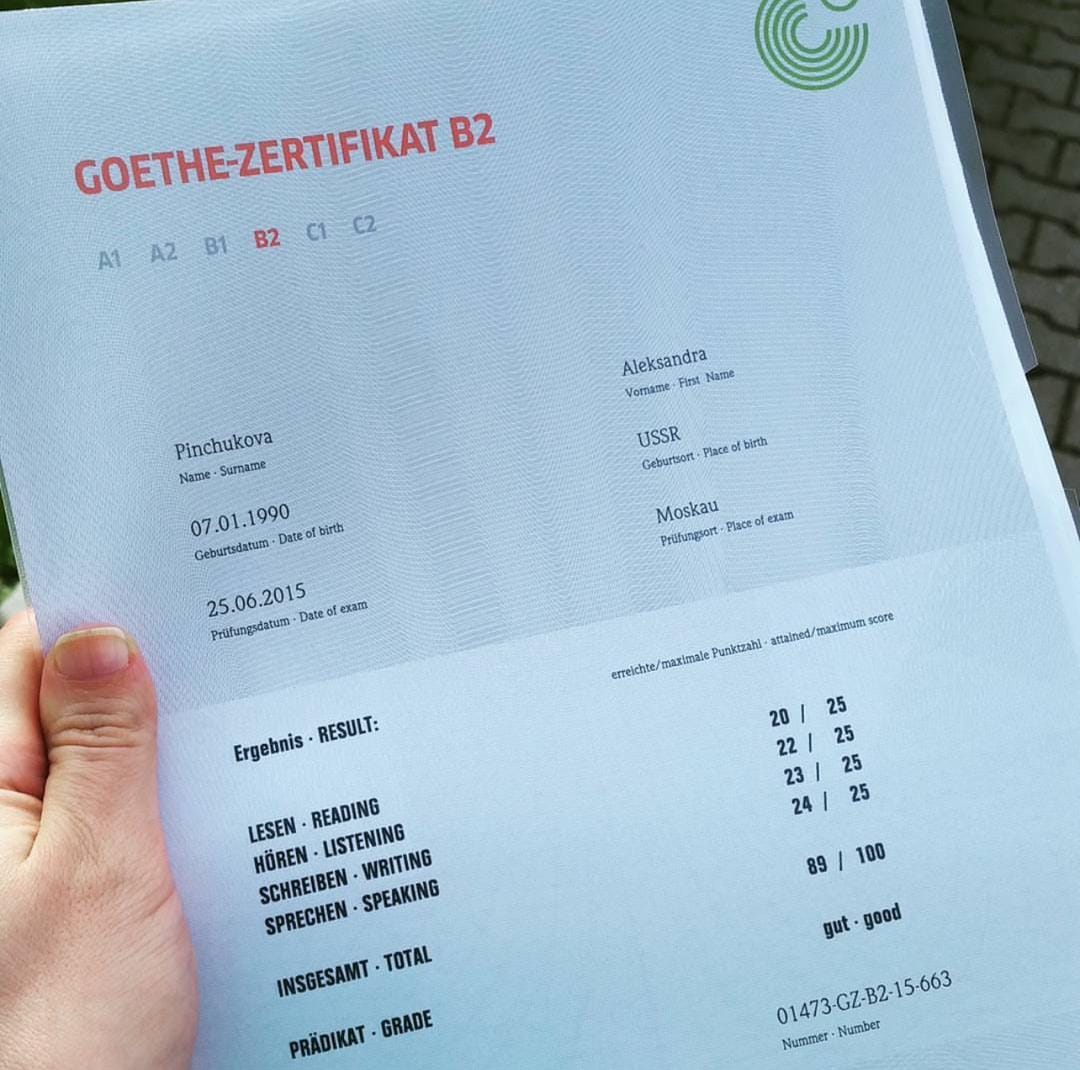

In general, it's an ideal idea to begin the process of acquiring an A1 form when it becomes apparent that an employee will be required to work in another country. Depending on the country of work, it may be possible for zertifikat goethe an employee to get an A1 form within two weeks after beginning their overseas assignment.

The A1 form requires a hefty amount of detail about the status of an employee's employment and the current position. It also needs to include the dates on which an employee will be working abroad. It is essential that this information is accurate in order to avoid any mistakes. Failure to do so could result in a fine.

Many companies use A1 Certificates to make it easier for employees to travel across Europe. This is especially applicable to businesses operating in an area where multiple languages are spoken. This type of certification ensures that employees will be in a position to communicate with their customers in the language of the country in which they are working.

A1 forms are essential for contractors and freelancers who work on short-term projects outside of the EEA. Consider, for instance, that a graphic designer from Manchester signs a six-month agreement with a company located in Italy. If she obtains an A1 certification she can continue to pay her UK National Insurance Contributions and not have to make any additional payments in Italy.

It is important to note that an employee can lose their A1 certificate if they do not maintain its validity while traveling abroad. It is crucial to keep a record of the time an A1 form expires and to renew it on time.

The process of obtaining an A1 form is a long-winded procedure that is based on the legal nuances of various international laws as well as the specific requirements of an employee's home and host country. GoGlobal streamlines the procedure by guiding clients through each step and ensuring that all documentation is in compliance with regulations.

4. Delivery

The A1 certificate is vital to ensure that employees who work in EU countries receive the proper treatment. This includes non EEA countries like Norway and Switzerland with an agreement with the EU and them. These regulations remain in effect despite the UK's decision to leave the EU. With significant updates to the process and common challenges encountered by applicants, it is crucial for employers who send their employees on international assignments to be well-aware of the A1 requirements.

CIBT Assure streamlines A1 and reduces compliance risks for clients. CIBT Assure provides expert guidance throughout the entire process, ensuring that every employee submits their application in a timely manner and without error. CIBT Assure's secure, automated electronic application and tracking system cuts down the time needed to complete each submission. It also allows HR departments to seamlessly integrate the solution with their existing payroll and HR systems for automated data pre-population as well as real-time status updates.

CIBT Assure simplifies the A1 process and provides a range of tools and resources that aid employees in understanding the. Employees will be kept updated and receive regular reminders and updates with the help of an experienced team and a mobile application for Goethe Zertifikat B2 Kaufen free, and a comprehensive guidebook. A centralized portal also provides a consolidated view of the status of each A1 submission.

For employees for employees, the CIBT Assure guidebook covers the entire process from start to finish, providing helpful tips and best practices. It also provides guidelines on when to submit each type of A1 application. It assists employees to understand a1 deutsch zertifikat Kaufen Testdaf Zertifikat online (lovewiki.faith) their status as multi-state or detached workers, and identify any gaps in information they have given to HMRC.

The A1 process can be complex and time-consuming, particularly for those who have to manage it on their own. This is why it's important for employees to use an expert who can manage the process on their behalf. This will reduce their risk of making a mistake and ensure they continue to receive coverage from the social security agency in their home country while in the EU. The no-risk A1 Certificate cheat sheet from CIBT Assure is a great source for processing tips, common problems and practical solutions.

The A1 process can be complex and time-consuming, particularly for those who have to manage it on their own. This is why it's important for employees to use an expert who can manage the process on their behalf. This will reduce their risk of making a mistake and ensure they continue to receive coverage from the social security agency in their home country while in the EU. The no-risk A1 Certificate cheat sheet from CIBT Assure is a great source for processing tips, common problems and practical solutions.

As the global workforce expands and changes the process of ensuring compliance with international employment regulations is becoming more difficult. Recent changes to A1 forms, along with common issues, highlight the importance of knowing these forms.

If you're traveling for business in several European countries A valid A1 certificate is required. But do you know when it's needed and how to get one?

1. Getting Started

The A1 Certificate streamlines cross-border work arrangements. It is a practical solution that is also legally sound for both employees and employers. The certificate guarantees that employees are not subject to the social security laws of more than one country, thereby preventing overpayments and administrative burdens. Anyone who is posted to an EU member state is required to carry this certificate. However, it can be used by employees who travel to other countries for business purposes such as attending conferences, meetings or fairs.

The procedure for getting an A1 certificate is different from country to country, however the fundamental steps are the identical. Employees should first confirm their eligibility, then complete the appropriate form with the competent authority. The form includes the information about their home country as well as the employer and destination country they will be working in. In most cases, it is best to complete this form online. Then, employees must submit the form along with the relevant documents to their home country's social security authorities.

After the A1 certificate is issued, it is able to be used in any country of the European Union. However, there are simplified procedures for those who frequently travel to different EU countries. For example If an employee or self-employed worker frequently engages in business in two or more Member States it is possible to apply for a type of permanent certificate that allows them to continue contributing to the system in their home country for a period of up to two years.

Those who don't secure an A1 certificate prior to going for a trip related to work could be penalized with fines. Inspectors from France, Austria, and Switzerland have launched a recent series of inspections targeted at companies that do not give their employees the required documents. Local authorities can refuse access to a construction site in the event that, for instance employees are sent there without an A1 certificate. Employers and hosting firms that do not secure their employees A1 certificates may also be penalized with fines. It is important to start the A1 certification process as soon as possible.

2. Documentation

The A1 certificate is an important piece of documentation for workers who travel to different countries frequently to work. The certificate demonstrates that the worker is covered in his or her home country. This permits them to avoid paying social insurance premiums in other countries. This could save companies a lot of money over the long run. But, it's crucial for employers to be aware of the documents required by their employees to complete this form.

Employees who work abroad must possess a valid A1 certificate to avoid paying penalties and fines. This is particularly true for project workers who may be required to display the certificate when entering hotels or attending conferences. It's also helpful to keep up-to-date with the most recent A1 certificate rules and regulations, since there have been some recent changes that could affect the way this process is conducted.

The primary goal of the A1 certificate is to stop social dumping. This occurs when an employee from a member of the EU is transferred to another state without being covered by the social security system in their home country. The A1 certificate is designed to prevent this by proving that the worker is covered in their home country. Employees, civil servants and self-employed individuals must get an A1 certificate when they're sent to another EU member state or Iceland, Norway, Liechtenstein, or Switzerland for work-related reasons.

A1 certificates are usually issued by the health insurance company for the person in question. The form is essentially an email that contains details like the name of the person and address. It also has a specific area which lists the country in which the person intends to work, as well as an explanation of the nature of work to be carried out there.

If an employee plans to work in the UK it is necessary to include information regarding their schedule and activities that generate income. Keep accurate time and location records to ensure that you're eligible to receive the A1 certificate if the local authorities want to inquire about your information.

3. Payment

A1 Certificates prove that employees contribute to the social security system of their home country when temporarily working in an European country. This can help to avoid social and wage discrimination in the event of short-term cross-border work assignments. It also allows employers to avoid double contributions in cases of multiple placements that overlap in different countries.

In general, it's an ideal idea to begin the process of acquiring an A1 form when it becomes apparent that an employee will be required to work in another country. Depending on the country of work, it may be possible for zertifikat goethe an employee to get an A1 form within two weeks after beginning their overseas assignment.

The A1 form requires a hefty amount of detail about the status of an employee's employment and the current position. It also needs to include the dates on which an employee will be working abroad. It is essential that this information is accurate in order to avoid any mistakes. Failure to do so could result in a fine.

Many companies use A1 Certificates to make it easier for employees to travel across Europe. This is especially applicable to businesses operating in an area where multiple languages are spoken. This type of certification ensures that employees will be in a position to communicate with their customers in the language of the country in which they are working.

A1 forms are essential for contractors and freelancers who work on short-term projects outside of the EEA. Consider, for instance, that a graphic designer from Manchester signs a six-month agreement with a company located in Italy. If she obtains an A1 certification she can continue to pay her UK National Insurance Contributions and not have to make any additional payments in Italy.

It is important to note that an employee can lose their A1 certificate if they do not maintain its validity while traveling abroad. It is crucial to keep a record of the time an A1 form expires and to renew it on time.

The process of obtaining an A1 form is a long-winded procedure that is based on the legal nuances of various international laws as well as the specific requirements of an employee's home and host country. GoGlobal streamlines the procedure by guiding clients through each step and ensuring that all documentation is in compliance with regulations.

4. Delivery

The A1 certificate is vital to ensure that employees who work in EU countries receive the proper treatment. This includes non EEA countries like Norway and Switzerland with an agreement with the EU and them. These regulations remain in effect despite the UK's decision to leave the EU. With significant updates to the process and common challenges encountered by applicants, it is crucial for employers who send their employees on international assignments to be well-aware of the A1 requirements.

CIBT Assure streamlines A1 and reduces compliance risks for clients. CIBT Assure provides expert guidance throughout the entire process, ensuring that every employee submits their application in a timely manner and without error. CIBT Assure's secure, automated electronic application and tracking system cuts down the time needed to complete each submission. It also allows HR departments to seamlessly integrate the solution with their existing payroll and HR systems for automated data pre-population as well as real-time status updates.

CIBT Assure simplifies the A1 process and provides a range of tools and resources that aid employees in understanding the. Employees will be kept updated and receive regular reminders and updates with the help of an experienced team and a mobile application for Goethe Zertifikat B2 Kaufen free, and a comprehensive guidebook. A centralized portal also provides a consolidated view of the status of each A1 submission.

For employees for employees, the CIBT Assure guidebook covers the entire process from start to finish, providing helpful tips and best practices. It also provides guidelines on when to submit each type of A1 application. It assists employees to understand a1 deutsch zertifikat Kaufen Testdaf Zertifikat online (lovewiki.faith) their status as multi-state or detached workers, and identify any gaps in information they have given to HMRC.

The A1 process can be complex and time-consuming, particularly for those who have to manage it on their own. This is why it's important for employees to use an expert who can manage the process on their behalf. This will reduce their risk of making a mistake and ensure they continue to receive coverage from the social security agency in their home country while in the EU. The no-risk A1 Certificate cheat sheet from CIBT Assure is a great source for processing tips, common problems and practical solutions.

The A1 process can be complex and time-consuming, particularly for those who have to manage it on their own. This is why it's important for employees to use an expert who can manage the process on their behalf. This will reduce their risk of making a mistake and ensure they continue to receive coverage from the social security agency in their home country while in the EU. The no-risk A1 Certificate cheat sheet from CIBT Assure is a great source for processing tips, common problems and practical solutions.댓글목록

등록된 댓글이 없습니다.